Facebook has partly cancelled the ban on cryptocurrency ads

Now the company will allow the social network to publish the cryptocurrency ads from the “pre-approved advertisers.” We remind you that the ban on the cryptocurrency ads was introduced by Facebook in January.

The company Facebook has decided to review its new advertising policy and has abandoned the ban on placing all the ads related to cryptocurrency on the social network. This was announced by Rob Leathern, the director of product management at the company's website.

”In January, we informed about the new policy for ads”,

– Leathern reminded, adding that then the representatives of Facebook clearly made it clear that this policy has touched upon a wide range of problematic situations, and the company is currently working to tackle fraudulent and misleading advertising practices more effectively.

By doing a certain amount of work, the soc-network employees have examined the company's previously approved policy and decided to allow the placement of cryptocurrency ads and the related content on the social networking starting with 26 June. But such statements, as the representative of the company emphasized, will only be published from the “previously approved advertisers.”

Leathern, however, stresses that the placement of ICO ads on the Facebook platform will still be banned. At the same time,the advertisers who want to publish the cryptocurrency ads on the Facebook platform, according to him, will initially have to submit a relevant application which will be examined by the social networking staff. The representative of the company pointed out that Facebook will continue to delete the misleading product ads.

The ban for the cryptocurrency and ICO ads was introduced by the social network in January. The representatives of Facebook explained that such a decision was made because many of the companies that post such ads are working dishonestly. Leathern emphasized that there is no place for misleading advertisements on the Facebook social network.

The company Tether has injected 250 million USDT in the market of cryptocurrency

The company Tether injected 250 million USDT in the market of cryptocurrency on the 25th of June.

The previous such smart action took place a month ago – on 18 May. As the analysts point out, after such actions, a short bit of Bitcoin appreciation followed by a more severe drop in the rate.

There are currently similar trends. As Charlie Lee, the founder of Litecoin, points out, the unexpected increase in Bitcoin is always followed by the USDT's entry into the market. The situation is the same if you invest $ 250 million on stock exchanges, says Charlie Lee.

The Central Bank of Lithuania is afraid of the negative consequences, which can be caused by the investments made by the Russian investors on ICO projects in Lithuania

The Lithuanian regulator has announced that with the help of ICO, the Russian organized crime companies may try to launder proceeds from criminal activity.

“We constantly remind everyone about the possible risks – I do not want to see 70% of your ICO investors come from Russia. The uncontrolled capital inflow from Russia is not in line with our national interests,” stated Marius Jurgilas, the Member of the Board of the Bank of Lithuania. In the past year, the ICO-projects raised the budget of Lithuania by $ 500 million, and it is planned that in 2018, the state economy will grow by 3.1% due to the start-up companies.

AdvCash Review 2018

What is AdvCash?

Advcash — a universal payment service for entering, withdrawing or exchanging electronic money and cash. The highest quality online banking.

This automated service allows you to enter, withdraw or exchange money in many various electronic currencies and cash (paper) using your own payment card. This payment service is a completely independent system and completely protects you from the attention of your state. AdvCash payment card(unfortunately, AdvCash MasterCard at the moment is temporarily unavailable) is serviced in 200 countries of the world. The commissions for servicing payment transactions are acceptable.

In addition, there are organized

- An internal interest-free transfer of funds between the users of the system;

- Money transfer to any Visa or MasterCard payment card;

- Money withdrawal and exchange for a large number of electronic currencies etc.!

Money deposit options

- Wire-transfers (billing, affiliate programs, etc.);

- Electronic money, online payment systems (Payeer, ePay, Bitcoin, eCoin, OKPay, Perfect Money, QIWI, Webmoney);

- Internet banking (Альфа-Банк, Cбербанк, Промсвязбанк, СвязнойБанк, Приват24);

- Payment cards Visa and MasterCard;

- And more...

Money withdrawal options

- Withdrawal from Advanced Cash MasterCard;

- Electronic money, online payment systems;

- Convenient output to any card (Visa or MasterCard) all over the world;

- Transfer to your bank account;

- Transfer by e-mail;

- And more...

Exchange

Advanced Cash allows to do fast and simple exchanges with many different currencies.

For example, you can quickly exchange EUR to Bitcoin or WebMoney to OKPay, which is very convenient when you need to make fast currency exchange.

Advanced Cash for professional traders

- Electronic wallet with support of 4 currencies;

- Free transfers within the system;

- Quick and convenient withdrawal of funds around the world;

- Virtual and Plastic cards;

- Cashing checks and wire transfers.

Advanced Cash for business (affiliate program, provider, exchange, etc.)

- Convenient and multifunctional API;

- Fast integration with PHP, Ruby, Python, Java;

- Convenient entry: electronic currencies, bank payments and much more;

- Tools for organizing mass payments;

- Payments within the system (on cards, on accounts, etc.).

Advanced Cash for everyone

- Transfer to the people who do not have an account in the system;

- Payment for various services directly from your wallet;

- Referral program;

- Prompt and effective support;

- Continual addition of new features;

- Security and banking level encryption (PCI DSS Level 3);

- Reliability, legality and full legal transparency.

In the very near future

- Convenient iOS and Android applications

About the company (info from the project site)

Always ahead. Having worked in the field of finance and electronic payments for more than two decades, Advanced Cash has created a simple and universal system of Internet payments that can solve any of your tasks.

Faster than the usual money transfers, more profitable than a regular bank account, it is more convenient than other online currencies. Advanced Cash is a simple and advantageous account replenishment and withdrawal of funds exactly where you live. By using Advanced Cash, you will carry out global calculations for local rates. Register and you will see for yourself.

Buy, sell or exchange AdvCash on XMLGold.eu

XMLGold online e-currency exchanger gives you an opportunity to convert AdvCash in many different e-currencies and cryptocurrencies like Bitcoin, Perfect Money, Payeer, ePay, Sepa transfer, Bank transfer, Tether, Litecoin, Exmo code, Wex code, eCoin code and others. XMLGold will guarantee fast and secure transactions, together with acceptable exchange commissions.

The related articles:

The SEC does not intend to adapt its rules to cryptocurrency

The Securities and Exchange Commission will not change the laws and regulations of the securities market in order to adapt to cryptocurrencies management. The head of the institution announced it in an interview with CNBC.

"We do not intend to undermine the traditional view of securities that have been operating for a long time ",

"We do not intend to undermine the traditional view of securities that have been operating for a long time ",

– the commission chairman Jay Clayton claimed, adding that the United States has set up a securities market with a total capitalization of $ 19 trillion on these terms.

The SEC does not plan to match its requirements by pleasing the companies whose funding is attracted by placement of the initial coin offering (ICO).

“If you have a coin or a share and you want to sell it through private placement, you must comply with the relevant rules,” Clayton announced. “If you wish to go through an IPO with your coin, please join us. The SEC will help the make public placement for issuers who are ready to undertake commitments complying with legislation”.

The commission also touched upon the regulation of cryptocurrencies.

“If I give you money for business development, but you promise me a profit in the future, then such an asset is already a security and is subject to regulation."

In order to determine whether an asset is a security, the Howey test, which was invented by the United States Supreme Court in 1946, is carried out. It classifies a security as a cash investment in a common measure from which the investor hopes to profit without effort. In March of this year, when Cleiton had already made it clear that ICO was in fact a sale of securities, he emphasised that today, if it is a security, its issue and circulation are regulated.

The companies which issue cryptocurrencies claim that their assets due to their practical use belong to another category. In these circumstances, the Financial Regulator is forced to balance between protecting consumer rights and stimulating innovations in a billion-dollar cryptocurrency market. For this purpose, the SEC has introduced a new position – Assistant to the Director of the Cryptocurrency Finance Division and Chief Advisor for Digital Assets and Innovations.

How to choose a Forex broker?

Both Forex beginners and professionals agree: there are a lot of brokers available on the market, and finding the right one is sometimes not so easy.

According to the law, a natural person cannot access the currency market in a direct way, hence the market is supersaturated with intermediaries and every one of them is positioning himself as a reliable broker. However, in our everyday life, from time to time, we face dishonest practices –it concerns the companies which are financially interested in closing clients currency transactions with a loss. Quite often they have not received an appropriate financial regulator licence. There are even cases when companies are cheating and indicate a non-existent license on the website.

How to make sure that the selected Forex broker is a professional and reliable partner? How to choose the right broker?

Before starting to work with a broker, it is necessary to carefully examine all the information available to him, paying attention to seemingly minor details. The information about any broker can be checked at the official supervisory authorities, which will make sure that the broker really has all the necessary permits.

How to recognize a dishonest broker?

Intrusive offers

Some people have come across a situation where an unknown caller who does not know anything about you suddenly in a telephone conversation starts to promise you a dizzying profit, for example, by investing in gold, platinum, cryptocurrency (Bitcoin) or other instrument.

It's very difficult to get rid of such callers. The argument that you are busy does not work – they would offer a call at another day and time. Often, they are good psychologists, promising a guaranteed profit without any efforts by investing in “only 100 or 150 euro”, and they look very surprising if the client is not ready to immediately get involved in this adventure. The only way to get rid of these “professionals” is to convince them that you do not have the money – then they will not be interested in you anymore.

In their promises to help you quickly to get rich, such a broker never warns clients of risks, but only tells them about the positive features and potential benefits of a currency or CFD trade.

Suspicious jurisdiction

The country where the brokerage company is established may also be a substance for reflection. Cyprus, Malta and the United Kingdom are the most beneficial choice for the Forex broker and, at the same time,the safest choice for the EU trader. Unfortunately, in Europe, no unified regulator of financial services has been established,therefore, national legislation is in force in this area, which in turn is based on the Markets in Financial Instruments Directive or MiFID. Therefore, the situation in different countries may vary.

Most rigorously, this area is regulated in the United States.Forex brokers are extremely carefully monitored in Israel, but since 2013, in New Zealand, where legislation has become so rigid that many brokerage companies have moved their activities to EU countries.

However, many brokerage companies are still registered in the jurisdictions such as Belize, Seychelles, Vanuatu, Saint Vincent, the Grenadines, etc. Legislation in such countries is less strict, therefore, it is easier to carry out suspicious financial activities in these areas. It is risky to co-operate with such companies: it is very likely that they will be interested to create a delusion that investors have lost their funds, as a result of which the company would get the maximum profit.

Of course, recovering lost money in this case is almost impossible. Get the information on these companies concerning the registration and licenses that give them the right to take specific actions. Fraudsters will give false answers in this case.It is possible that such a company does not have an office or it is in a distant country.

Check if the company has a physical office or representation and if the address indicated on the website matches the legal or actual address, or it is invented. If the company has neither an office nor employees, you should think twice again before you give them your money.

How to choose a reliable Forex broker?

What features to look for before starting to co-operate with any of the Forex brokers?

Reputation

Large financial institutions, such as banks, are more strictly monitored by the state than smaller market players. Therefore, banks take great care of their reputation, hence the terms of service are clearer and help to reduce the potential misunderstanding between investors and the bank.

Contract

Each serious player in the brokerage market must have an elaborated model contract specifying the rights and obligations of both parties, the terms of cooperation and dispute settlement rules. Such a contract not only proves the integrity of clients, but also helps to avoid unnecessary problems in the future.

Conditions

One should not blindly believe in seemingly beneficial offers, which promise quick access to wealth. Similarly, promise of immediate opening of an account,huge free bonuses and transactions without commission should be treated with caution. Such offers are often just an ad trick, which helps to attract inexperienced investors. It is necessary to carefully evaluate the trading conditions – what is the size of the yield spread of the profit, the minimum amount of collateral, and commissions. It is also important to understand whether the broker offers some kind of protection in the event of a negative account balance. Verify that there are no hidden fees in the service fees.

Trading platform

Today, Forex Terminals have a wide choice. They can vary in terms of speed, functionality, ease of use, security level, automation capabilities and compatibility with your operating system. It is best to try several platforms and then make the final decision and choose the one that suits you best.

Service

There is no need to hesitate to call the broker who is interested in you and ask unclear, awkward questions. This way, you will be able to assess his professionalism and the ability to quickly and successfully respond to all possible difficulties.

License

Finally, we remind you of the need to select a broker who has received an appropriate financial regulator licence which gives him the right to operate in a particular area. Consequently, such a broker will be required to comply carefully with all statutory provisions.

Important!

We have replaced the previous link to our rates in XML with the new one: https://www.xmlgold.eu/en/request/rates.xml

The Polish regulator launches a campaign against Forex and Cryptocurrency investments

Apparently, the Polish Financial Regulator KNF is tired of fighting with dishonest practices in exchange markets by laconic and individual public alerts, and he has decided to act in an aggressive and universal manner.

As a result, Poland starts a national media anti-ad campaign against investments in Forex and Cryptos. The television campaign is scheduled for June, and will be accompanied by radio advertising and video materials on social networks.

The main message of this campaign is financial education and warnings of potential OTC users for the high risks associated with investments in cryptocurrency instruments and the trade in credit crunch as a whole. In other words, the regulator intends to focus more attention on the risks concerning easy profit makers.

The National Financial Regulatory Authority – the Polish Financial Supervision Commission (KNF) – hides behind the campaign. It warns of investment risks through publicity on public radio and television channels, as well as through printed and digital media. The publication of the respective anti-advertisements on the air is scheduled for June. It is known that the KNF has already allocated 1.75 million zlotys for the radio and television campaign and 615 thousand zlotys for the campaign on the Internet and social media.

Jacek Barszczewski, the representative of KNF commented as follows:

“The aim of the campaign is to prevent those who want to invest their money to entrust those who offer “easy profit without risk”. It is entirely possible that such schemes may include the features of the financial pyramid, that is, the investor derives its profits at the expense of other investors.”

The campaign also emphasizes the lack of regulatory and normative acts in the sphere of cryptocurrency assets and the ICO industry. The regulator draws attention to the legal uncertainties in this area, which, in turn, expose the potential investors to the vulnerability of the capital, unlike the strictly regulated traditional financial markets.

What Bitcoin really is, how it works, how to buy it and how to earn it

If you still do not know what Bitcoin is and everything related to it, then definitely you are reading the right article!

Briefly about Bitcoin history

The current article also will tell you a bit about the ways of using Bitcoin, but besides the mentioned ones, there are many other ways of using and they grow in number with each passing day, month and year, due to the fact that people begin to recognize the cryptocurrencies and to accept them on a daily basis.

Let's start with the beginnings: Bitcoin is the first cryptocurrency which was created based on the blockchain. Right now, according to the information provided by coinmarketcap, there are already almost 1630 different cryptocurrencies in circulation, each with its own aims and nuances.

Bitcoin is a digital currency based on cryptographic principles for currency regulation as well as the creation of new units. As Bitcoin was the first of these types of currencies, it was and still is the most valuable of all currencies, and is called the decentralized digital currency. Bitcoin is also considered to be the only one of the cryptocurrencies. The other ones that were created later are called alternative cryptocurrencies or altcoins.

The origin of Bitcoin

For the first time the concept of cryptocurrency was mentioned by Wei Dai in 1998. He offered a new idea of the form of money that would use cryptography to control the creation of new entities, and to control payments with this new currency, instead of central authorizing authorities being those who control it.

Specifically, Bitcoin was first talked about in 2009 when Satoshi Nakamoto presented his concept of this cryptocurrency to others. In 2010, Satohi Nakamoto himself abandoned the project, but since then, many new program developers have joined it to continue this project.

The real name of Satoshi Nakamoto is not publicly known, so people are talking about him by using this pseudonym. There are a couple of authorities who have said that they are informed about his true identity, but there is no clear information about it.

It is good question – who was the creator of Bitcoin and what was the real aim for this project. Also why the creator of the Bitcoin hid his real identity...

By itself, Bitcoin is designed as an open source project and each programmer has access to this project, although they can create their own alternative to it or use it to implement in other places.

The mystery of what stands behind the creation of Bitcoin is still actual today and will certainly not disappear so soon. Based on the name of Satoshi Nakamoto, the Bitcoin decimal values have also got their name. The same as the Euro has cents, Bitcoin has Satoshi.

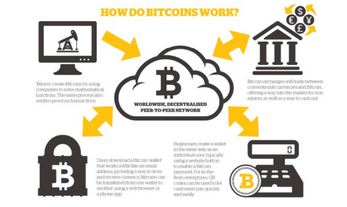

How Bitcoin works

For most of the cryptocurrency users, Bitcoin is only a currency that is kept in a wallet and can be used to purchase various goods, or to do other transactions and exchanges. But if we discuss the issue in depth we will find out that Bitcoin relates to the blockchain system, through which all payments are made, and all of these payments are publicly visible to everyone. Also, all the wallets in which Bitcoin is stored can be seen in the public ledger of the blockchain.

Although all payments made between the users are visible to anyone, they do not contain any personal information, except the address of the wallet and the amount of the cryptocurrency. Other information is not available for viewing to other persons.

In order to provide the transfer of payments from one cryptocurrency wallet into another, it is necessary to approve these transactions, or in the form of mining, they are processed and sent to the blockchain system, for which also the miners receive a certain remuneration for their work, which also consists of a commission payable on conducting transactions. Anyone who wants to exchange the power of his computer for remuneration for processed payments and block decoding can become a miner. Of course, the electricity costs and the power of your computer should be taken into account, and it can also be considered if it will be profitable at all. Most often, unfortunately, you will not gain any profit, so it is better to leave it to others who have been doing it for many years and have specialized computers for mining.

Where and how is it possible to get Bitcoin?

One of the most popular and user-friendly platforms is Coinbase, where it is possible not only to buy Bitcoin, but also to store it and use it as a cryptocurrency wallet. Besides Coinbase, Blockchain is also widely used, which is also very convenient and offers a much more convenient commission for services.

In addition to the above-mentioned platforms, the XMLGold e-currency trading platform is also a widely used platform for the purchase of Bitcoin, which allows to convert Bitcoin into many different e-currencies (Perfect Money, AdvCash or Advanced Cash, Payeer, ePay, Sepa Transfer, Online Bank Transfer, Ethereum, Tether, Bitcoin Cash, Litecoin, XMLToken) or to withdraw it from ATM using the XMLGold Prepaid Card.

How to earn Bitcoin?

The popular way is to get Bitcoin by mining. By using the power of your computer or by purchasing mining contracts and receiving passive profits from them. These websites work on the principle that you rent your computer power to others, respectively, the more power you rent, the more you earn with bitcoin mining. One such site (as an example) is HashFlare, where the minimum price is starting from $ 2.20, which is enough to understand how it works, and after that you can already invest more. There is also the option of imposing that all incomes automatically purchase more power and, after summing up, in a few months, you can already make significant profits without very high initial investment.

There are many different ways of how and where to get Bitcoin. One of the ways, for example, is to buy Bitcoin mining packages from USI-Tech, where one package will cost +/-50 EUR and you will receive +/ -1% per day for the next 140 working days, as a result, you will generally receive around 40% profit from your initial investment.

Also, the best option here is to buy several packages at once and set it to the mode which provides that automatically new packages are obtained as soon as the account balance of profit is sufficient, and for a few months to forget about this all to see afterwards how many new packages will be automatically purchased and what already is a profit in just a couple of months!

Of course, as with all currencies, it is also possible to trade by Bitcoin and earn money due to fluctuations in prices. If you have got experience in this sphere and the desire to learn, then you can certainly consider it as a good opportunity to grow your Bitcoin account.

There are also many and different websites where you can earn Bitcoin by watching ads or take out a certain amount hourly or at other time intervals. Most of these addresses require a considerable amount of time to get some profit and there are better alternatives from the point of view of time. However, there are also addresses, like FreeBitco, where you can get various Bitcoin amounts once per hour, as well as participate in lotteries and use other ways to get faster profits.

What is Bitcoin mining?

Basically Bitcoin mining is performed for two important tasks:

- To process and confirm payments made in the blockchain.

- To create new Bitcoins from mining different blocks.

I suggest watching the video where you will be told in a few minutes how the process works:

Bitcoin mining is a very complicated process from a technical point of view. Therefore, this process requires very powerful computers and systems to carry out this process as quickly and efficiently as possible.

If there are not many and powerful computers in your possession, it is necessary to engage in mining together with other users and hence, at the end, the prize will be divided among the performers depending on the amount of work done individually. If you alone try to do mining with your home computer, then it can take a very long time until you find just one block to work with if you find any.

The profit from Bitcoin mining depends essentially on the price and power of the computers, as well as the amount of time it takes. Therefore, all those who create the “Bitcoin mining farms” will choose the locations where the electricity prices are lowest.

The award received for solving blocks is determined to all blocks the same and at each specified time when the block volume is resolved, this value is divided by two, thereby increasing the cost of mining to get one Bitcoin as well as profit from it.

Where to store Bitcoin?

Bitcoin can be stored in different places, such as online wallets, program-type wallets, hard wallets, as well as stored as an investment to get your Bitcoin back later.

For more information on storing Bitcoin and alternative cryptocurrencies, as well as how to keep them safe, in nearest future we will create the article.

How to use Bitcoin to buy and sell goods

Theoretically, Bitcoin can be used to purchase any product or service because accepting or not accepting Bitcoin, as the form of payment, depends only on the seller or the company providing the service.

There are many large companies which accept Bitcoin as a payment form.

Apart from the large companies, there are also many small companies which accept Bitcoin as a payment tool.

It is, of course, easy to sell products using Bitcoin, since the seller himself can offer to buy goods by using this currency. Although it may be more difficult at first to find the buyers who buy goods by using Bitcoin instead of the traditional payment tools, however, it is certain that some buyers will without hesitation agree to use Bitcoin and purchase the product you sell.

Advantages of Bitcoin

- One of the most important advantages of using Bitcoin or other alternative cryptocurrency is the payment freedom provided by it.

- At any time, from anywhere in the world to anywhere in the world, it is possible to send Bitcoin from wallet to wallet. There are no days off, like bank charges, nor are you restricted by transfer time concerning the international or continental money transfers.

- In addition, when paying, depending on the choice of the wallet, you can choose what commission you want to assign to your transactions, from these commissions, it will also depend how fast Bitcoin is transferred from wallet to wallet. The sooner it is necessary to carry out this transaction, the commission will be more expensive, but most of the commissions are carried out in a reasonable period of time and still outstrip banking offers.

- You are fully in control of your account and making payments. Only you and the person who receives this payment are involved in the transactions. There are no third parties involved.

- All payments are clearly visible in the blockchain ledger and can be tracked.

Disadvantages of Bitcoin

Most often, everything in the world has positive and negative aspects. Bitcoin is no exception:

- One of the negative aspects is that Bitcoin is not yet sufficiently widely spread. Many people do not know about it, from those who know, there are quite many who refuse it, there are also some other reasons, why Bitcoin is not sufficiently spread, and often it is not possible and in the nearest future will not be possible to make payments with Bitcoin.

- While Bitcoin is still relatively unknown, its value is very volatile, and as soon as an individual person makes a big deal, it bounces on the Bitcoin price. As soon as a prominent person expresses his opinion on Bitcoin on the social networking sites, once again, its price may fluctuate due to rumours and other factors.

- Next thing, (one more disadvantage, )Bitcoin is still in its infancy state from the software point of view, and in the future, based on blockchain technology, there will be developed many different systems and devices.

- Bitcoin mining energy & costs. By the end of 2018, the energy required for BTC mining will be near to 0.5% of the planet's energy consumption. Current data are found in the research performed by the economist Alex de Vries. 0.5% definitely is a shocking number. This is a large difference compared to the traditional financial system. And this growing energy consumption will certainly not helping resolving climate issues.

Conclusion

At its very beginning, Bitcoin was created as an anonymous payment system that protects a privacy of a person. However, we are well aware that if Bitcoins will become an official global currency, then the privacy of personal data will be forgotten also in relation to Bitcoin. The state financial institutions will track illegal money flows. And this type of control mechanisms is still further developing. This may result in the fact that the initial use of Bitcoin and blockchain, the level of privacy over time can be very different from the first version. This can lead to the opposite, namely, technologies such as Bitcoin and blockchain, on the contrary, can contribute to personal data availability, control provided by the state and the services concerned. There is no reason to deny that many discoveries in the name of human progress have led to things like – genetically modified food, dangerous chemicals hiding in everyday products, atomic weapons, etc., which have done and are doing much harm to people. Let's be honest, the privacy that cash offers can not replace any other payment method. We are very hopeful that the mysterious bitcoin creator Satoshi Nakamoto and his invention is in no way connected with any particular idea of some government, institution or influential person for creating a controllable society.

And having a deeper insight into the so called human “progress" from the existential point of view, we can only hope that Bitcoin and these new technologies have nothing to do with the text from Bible, Revelation 13:16-18.

Let’s hope that it will not end with a nicely designed chip (with, for example, ID info, tax payer number, money wallet number) in your forehead, say, after 20 - 50 years.

The conception – everything that is new is automatically better than the old one is short-sighted and not correct. So let's not be naive and take every new idea and innovation with healthy, careful criticism rather than naive sincerity. As the saying goes, "The only free cheese is in the mouse trap".

Time will tell whether these new digital technologies like bitcoin, blockchain etc. are just short-term trends and the way how to get quick money, or whether they are ongoing and long-term technologies which are socially beneficial, perform significant functions for our society and will keep their development continuous. Will it lead to good or bad outcome? Time will tell.

At the conclusion of the article, for those who have followed so far, I would like to thank for the time allotted for reading this article.

Note: XMLGold does not promote neither non-use nor use of bitcoin. This author's article is republished just for informational purposes. Digital technologies, currencies are just at the initial stage, and is unsufficiently regulated financial sphere, therefore – quite a risky type of investment.