Important Announcement: XMLGold.eu Migration to XMLGold.is

We are informing you that we are in the process of migrating to a new domain - XMLGold.is. Xmlgold will continue to serve you as before, providing the highest quality and the best exchange rates. Follow the news, and contact support in case of questions.

Limited-Time Offer: Exchange USDT TRC20 to Perfect Money with a Bonus of 4.8%!

8 comments

8 comments

We're excited to announce our latest exchange bonus - you can now enjoy a bonus of 4.8% on all USDT TRC20 to Perfect Money USD transactions! Don't miss out on this limited-time offer and take advantage of our fast and secure exchange service.

NOTE: This offer is valid until the stock runs out!

Exchange USDT TRC20 to Payeer EUR with a Bonus of 1.9%!

We're pleased to announce a special promotion: receive a 1.9% bonus on USDT TRC20 to Payeer EUR exchanges for a limited time. Optimize your transactions with this exclusive opportunity.

Exclusive Offer: 1.7% Bonus on Bitcoin to Perfect Money USD Exchange!

1 comment

1 comment

We are thrilled to introduce a special promotion for a limited time. Exchange Bitcoin to Perfect Money USD and receive an additional 1.7% bonus as our token of appreciation.

This unique opportunity allows you to optimize your transactions and maximize the value of your exchanges. Seize the moment and take advantage of this exclusive offer.

Perfect Money Review: Sign Up, Deposit, Withdrawal, Fee, Verification, Security

In this review we will look at the most important topics regarding Perfect Money: Sign up procedure, fees, verification, deposit, and withdrawal options. We believe this will be one of the most detailed and accurate Perfect Money e-wallet reviews to be found on the internet. Find out what Perfect Money is and how to use it. There is a lot of information, so get comfortable in your chair and let's start studying the Perfect Money payment system from A to Z.

What is Perfect Money?

Perfect Money is an electronic payment system that offers a range of features for secure and convenient online transactions. Anonymous money transfers over the Internet are made simple with Perfect Money, it is a reliable alternative for traditional online payments like bank transfers. Making a transfer no longer requires a trip to the bank or a lengthy wait at an automated teller machine. Perfect Money offers tremendous opportunities to internet users and business owners.

Perfect Money users may convert their funds into digital currencies in minutes and at a reduced rate. They have a long-standing financial arrangement that permits them to send and receive wire transfers from all over the world. Read the whole article to learn all you should know about the Perfect Money e-wallet.

Perfect Money users may convert their funds into digital currencies in minutes and at a reduced rate. They have a long-standing financial arrangement that permits them to send and receive wire transfers from all over the world. Read the whole article to learn all you should know about the Perfect Money e-wallet.

History of Perfect Money

Perfect Money, initially launched in 2007, is one of the world's most popular cashless payment networks. The company promotes itself as an excellent alternative for managing your assets quickly and securely. Its main advantage is that users' personal information is kept entirely confidential. Perfect Money Finance Corp is headquartered in Zurich, Switzerland, with offices in Hong Kong. Customers may now use Perfect Money to execute private transfers, including monthly payments, pay for goods and services via the Internet, keep cash and crypto-currencies with a profit on the balance, and much more. Perfect Money is also a frequently used e-currency on the XMLGold e-currency and cryptocurrency exchange. More and more online stores start to accept Perfect Money payments. Many online business projects have found this payment system to be useful. This payment method can be beneficial to you if you are interested in anonymous and instant payments. Despite its popularity, Perfect Money is a quite specific payment system. Consequently, we'll go through the payment system's features and tools in more detail.

Perfect Money Account Types

When you register on Perfect Money, you have the option of selecting one of the following account types:

Normal:

A new client who signs up on one of Perfect Money's website is offered a standard account. It has some cons, but overall it places no limitations whatsoever.

Premium:

Users who have kept their accounts active for at least a year are eligible for premium accounts. You must contact customer service if you wish to upgrade your account from ordinary to premium. An additional perk of a premium account is a discount of 2% on all Perfect Money transactions.

Partner:

Partner accounts are issued based on strong financial management. This account is for people who wish to improve the functionality of their websites for commercial transactions. These accounts are exclusively accessible to company owners that run their activities online. Having a partner account is an honor since it shows that you are reliable and trustworthy.

Perfect Money Sign Up Process

To use the Perfect Money e-wallet, you must first understand it. Perfect Money is a kind of electronic wallet, in some points, similar to PayPal, Skrill, Advcash, Payeer, and some other online payment systems. It enables users to send money and make and receive payments via the Internet securely and near-instantaneously.

Follow these steps to establish a Perfect Money account (e-wallet):

Step#1:

To start the process, you need to visit https://perfectmoney.com/

Go to the website and click "Signup" to register a Perfect Money account.

Step#2:

Fill up the fields with your details. You must first provide personal information to open a Perfect Money account.

The following is a synopsis of the data:

- Your full name.

- The city's name.

- The name of your nation.

- The postal code.

- Your email address

- Telephone and fax (Optional).

After that, the following information is provided:

- Account type: For most users, choose "Personal."

- The password for your Perfect Money account.

At the bottom of the section, you will need to enter the following information:

- Enter the turning numbers after this.

- Accept the terms and conditions in their entirety.

- Click “Register” to set up an account.

Step#3:

Go to your email to get your member ID. After completing the Perfect Money registration procedure, you'll get an email requesting you to check your inbox for a member ID.

Step#4:

Look through your inbox for a message with the subject "member ID" and open it.

Step#5:

Log in to Perfect Money using the ID you just received. Return to the Perfect Money interface and log in to your account by selecting the "Login" button.

The steps are as follows:

- Enter the membership ID you just received.

- Turing's number

- Finally, click "Authorize" to finish the login procedure.

The interface for your account appears when you log in. At this time, you have successfully established your Perfect Money account.

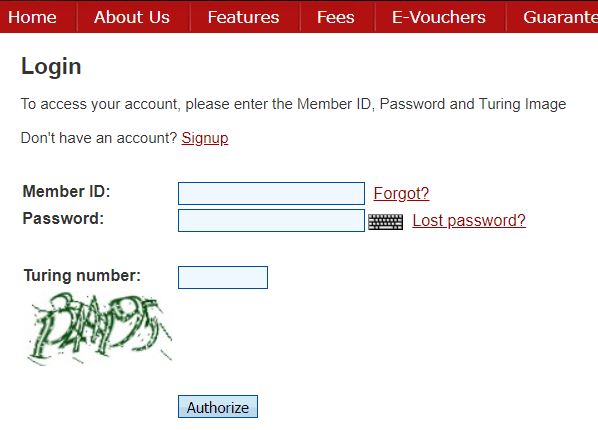

Perfect Money Login Process

The login process is fast, simple and secure.

To Login into Perfect Money website, go through the following steps:

- Step 1: Go to the "Login" tab.

- Step 2: Enter the client ID and password.

- Step 3: Double-check submitted information.

After successfully login in, the user navigates to the client area page. A toolbar at the top of the page enables you to go to the desired area of your account. The My Account feature welcomes users when they enter the client area. You may view the configured security settings and account reference information, such as transaction records, and all active accounts.

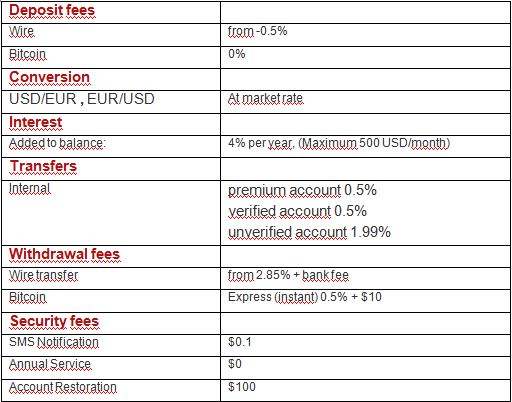

Perfect Money Fees

Perfect Money service fees have been minimized to ensure it is the most cost-efficient and convenient online payment solution. Perfect Money charges different costs for transferring money to, from, and within the account.

You may see the exchange rate for Euros, Bitcoins, Gold, or US Dollars on your account at any time. Commissions may change over time, so check fees with your broker one more time, but deposits are often free. Withdrawal fees are 0.5% for verified businesses.

Perfect Money “Fees” section: https://perfectmoney.com/fees.html

Perfect Money Security System

To safeguard your account, go to the "Security Centre" page. Here you may look at the IP address from which the user connects. You will get an email with a verification code each time you log in, and it is a procedure that should not be altered.

Perfect Money offers multi-level security for personal information:

1. Person Identity Check:

This tool is used to locate clients who have PM accounts. This gadget is a kind of Perfect Money artificial eye that cannot display the customer's face in real-time but can identify the computer used to establish the account. Suppose a Customer registration attempt is attempted from an IP address network or subnet that is not associated with the account holder. In that case, the account is blocked, and an extra security code is issued to the email address provided at account registration. The Perfect Money Support Center handles individual IP changes.

Suppose a Customer registration attempt is attempted from an IP address network or subnet that is not associated with the account holder. In that case, the account is blocked, and an extra security code is issued to the email address provided at account registration. The Perfect Money Support Center handles individual IP changes.

2. SMS Authentication:

This method creates a logical relationship between a user's account and mobile phone number. The system sends a confirmation code allowing the authentic account holder to be recognized. Because the time spent on the complete operation of code transmission and account entry is very short and insufficient for cracking, the SMS Login system is one of the most perfect and dependable types of Customer protection against unauthorized account access.

3. Code Card Protection:

The customer gets a card with a visual depiction of the code emailed to them. The system may ask the user to send a specific code from the card to verify a transaction in response to a random order. Most of the world's largest financial institutions employ code cards as a simple and efficient security method for transaction verification.

4. Anti-Fraud Screening System:

Perfect Money's anti-fraud scanning technology is a cutting-edge security solution that benefits its customers. Each login and every transaction is subjected to an anti-fraud screening procedure, which prevents money theft. This system includes patented activity-tracking algorithms that make Perfect Money a safer environment for consumers while making it unpleasant for those who attempt to use it illegally. After choosing this option, a file with the extension ".png" will be loaded, where you will find the codes that must be entered when making any financial transaction. The identical file will be sent to your email address. Enabling profile protection is an important step that helps the client to defend himself from intruders that try to hack into his account. It is an essential thing that should not be overlooked. You may use Perfect Money services immediately after registering and setting security measures. To reduce the commission %, we need to complete the verification process. To do so, go to the settings section and go through each step individually.

Perfect Money Deposit Options

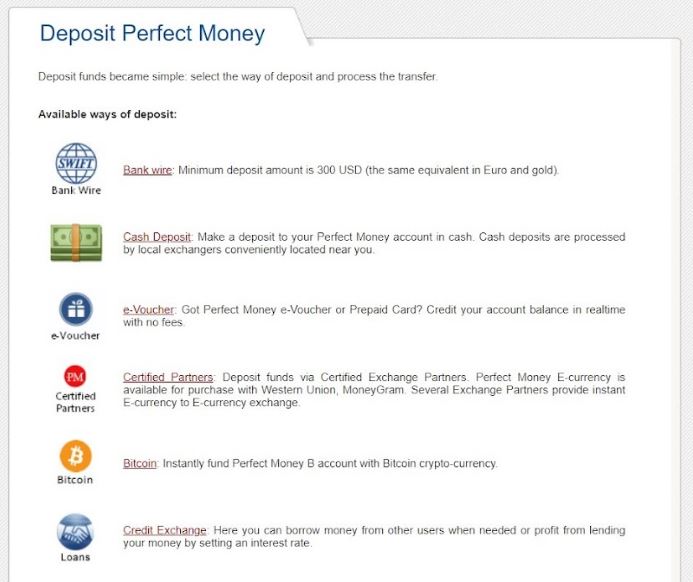

The users of the Perfect Money system may replenish their balance in many different ways:

1. Internal Transfer:

E-money sending via internal transfers is a definitely convenient way to exchange funds. To receive an internal transfer, you must supply the sender with your account number, email address, or mobile phone number. The system charges a fee to manage internal transactions; thus, the amount deposited differs from the amount communicated. The Perfect Money e voucher can be a convenient way to exchange funds between PM users as well. You may discover more about the costs in the "Fees" section.

2. Bank Wire:

Bank wire transactions are only available to verified account holders. It is straightforward to make a bank wire deposit, fill out a bank wire order form and choose a bank account for the transaction. Accurately entered information is rewarded with the ability to monitor the progress of your bank wire, so don't be superficial about giving the correct details. After completing the bank wire refill form, click the "Preview" button. Examine all the information, choose the primary and secondary authorized exchange services from the list of partners provided, and then click "Send." The primary approved transfer service provider will accept your order for review 24 hours after you put it. Suppose the primary exchange service provider cannot execute your petition. In that case, the application is transferred to an alternate approved exchange service provider. The maximum order processing time for each exchange service is 24 hours. If your request is approved, you will get an email and an internal system mailbox message with the bank account details to which you must pay your payments. Such bank account information is also available in your purchase's "Deposit" part. Funds from a bank wire may not appear in your Perfect Money account for up to 5 business days after they have been sent. A bank wire deposit of at least $300 is required.

3. Certified Currency Exchange Partners:

Use one of Perfect Money's approved exchange service partners to deposit funds into your Perfect Money account. All of the services stated on the certified exchange service partners' websites have been thoroughly vetted and tested, guaranteeing that transactions go smoothly. The highest Perfect Money Trust score at the time of writing belongs to XMLGold e-currency exchange. Below is a video tutorial on how to exchange USDT to Perfect Money:

Each exchange partner's terms and conditions, as well as deposit choices, can be unique. We strongly advise you to go over all of the content. Among the exchange service partners, many of them provide a diverse variety of Perfect Money purchasing options. You may fund your PM account with a credit card, bank transfers, cash, e-currency, cryptocurrency or a combination of these.

4. Bitcoin:

Bitcoin is a well-known cryptocurrency worldwide. To deposit Bitcoin into an account, a user must first create a deposition order containing the account number and the amount to be charged in Bitcoin, then inspect and confirm the order. After completing your purchase, the system will email you a Bitcoin address to which you must deposit the required amount within 24 hours. Your deposit will be completed once the Bitcoin is received, and each payment requires at least three confirmations. The amount sent to a Bitcoin address should equal the invoice value. If you choose to pay in two or more installments, be sure that the total amount matches the deposit amount specified on the purchase form. If the quantity of Bitcoin transferred differs from the amount specified in the order form, the process may take longer. Contact customer support if the funds have not been transferred into your account within 24 hours. The PM service charge for Bitcoin deposits is 0%.

5. Credit Exchange:

You may fund your Perfect Money account by borrowing money from other PM members. To utilize the Credit Exchange, log into your Perfect Money account and click on the appropriate area. You must complete an application or investigate existing loan offers that may interest you if you need a loan. If a lender's proposal meets a borrower's requirements, the funds are sent to the borrower's account after completing the transaction. Such transactions may be carried out automatically or with the borrower's permission. Loan applications contain the loan amount, repayment period, and interest rate. The Credit Exchange does not impose any additional fees. Lenders pay a standard 0.5 percent on demand to transfer money to a debtor. Borrowers must also pay a typical 0.5 percent fee when transferring cash to a lender.

Perfect Money Withdrawal Options

It is straightforward to convert Perfect Money electronic currency to real fiat money or other payment options.

Withdrawals are possible in the following ways:

1. Internal Transfer:

If you want to transfer money internally, choose the account from which you wish to send funds, then enter the account number and amount to send. The approach computes and displays a service fee as well as the amount received by the end user. You may choose to make a one-time payment or set up a subscription plan. The technology also allows transfers to mobile phones and email addresses, and fees vary based on the kind of account.

2. Bank Wire:

The procedure for withdrawing funds by bank transfer is simple. To make a bank wire withdrawal, go to the "Withdrawal" section, choose "Withdrawal Through Bank Wire," and fill out all necessary documents. Your account details may be obtained from your bank. Using the "Preview" option, ensure that all the information is accurate. You may also choose your leading authorized exchange service provider and secondary authorized exchange service provider from this page to finish your application. After double-checking your information, click "Confirm withdrawal," and your bank wire withdrawal request will record in the system. A Registered Exchange Service partner will process your request within 24 hours. As soon as the withdrawal process is completed, the bank wire invoice number will be supplied. The withdrawal limit amount is established for each authorized exchange service partner. This withdrawal option is only available to verified users.

3. Certified Currency Exchange Partners:

Use a partner of Perfect Money's Authorized Currency Exchange program to withdraw funds from your Perfect Money account. All of the services available on the websites of the exchange services partners have been thoroughly inspected and tested, guaranteeing that transactions go smoothly. Each exchange partner's terms and conditions, as well as deposit choices, can differ.

4. Bitcoin:

Bitcoin is a well-known cryptocurrency worldwide. To withdraw funds from a Bitcoin account, a user must create a deposit order indicating the report used, the applicable Bitcoin address, and the amount to remove. After you've double-checked everything, click "Confirm."

5. Credit Exchange:

Because the borrowed money will be returned to the exact location, offering a loan is not a technique for taking cash from your account. However, putting it to work for you is a simple way to make money.

Where To Use Perfect Money Payment System?

Perfect Money is a worldwide payment system that specializes in online transactions. Some things you can do with Perfect Money are listed below:

- Raise funds for various business initiatives over the Internet; make regular payments via the Internet; deposit funds in a secure electronic account; and earn interest.

- Purchase goods and services from many online shops and marketplaces (for example Buysellvouchers.com).

- Safely store your belongings in bitcoin without needing a separate wallet.

- Buy Bitcoin, gold, US dollars, and Euros online; borrow and lend Money on your terms.

What Can You Buy With Perfect Money?

With a Perfect Money account, sending and receiving electronic payments is simple. It allows for online payments from one digital currency system to another. You may configure your Perfect Money account through the user account profile to make automatic payments to numerous linked Internet firms. The minimum deposit is $1000, and the monthly interest rate is up to 4%. Currency exchanges, bank transfers, alternative payment methods, and e-Vouchers are all frequent means of Transferring Money to and from accounts. The ability for customers to obtain gold, Euros, and Dollars in real-time is one feature that sets Perfect Money apart from the many competitors. Perfect Money customers may pay their bills and transfer money promptly online. The technology is safe to use and does not need any special knowledge. PM is a global payment service that everyone on the planet may utilize.

Perfect Money vs Payeer

Payeer is a multi-currency payment system that allows you to send and receive fiat money and cryptocurrencies. There are advantages and disadvantages to using Payeer. Still, the main feature is that you may receive cryptocurrencies and withdraw in fiat money. Perfect Money, as a payment gateway for sending and receiving money, enables you to fill your account with Bitcoin and earn interest on it. You may withdraw Perfect Money in many ways, including Western Union.

Conclusion

Is Perfect Money the easiest method to deposit and receive funds anonymously from a foreign exchange account? In some specific cases, there are some more alternatives that can match this purpose. However in many situations, though, traders may find Perfect Money a more convenient alternative than other e-wallets and payment methods. Before opting to utilize Perfect Money, it's a good idea to do some basic research. Examine the About page, FAQ, and costs, and learn about the site's history. You might also find out whether any other vendors you know utilize it. Find out whether they had a good experience and thought it was quick, easy, safe, and reliable. Another option is to contact Perfect Money's customer service team, which is available 24 hours a day, seven days a week. Ask your questions and see what you get in response. It's a terrific way to assess whether the site caters to your demands. To summarize, always make financial decisions based on your knowledge and common sense. Many customers seem to be pleased with Perfect Money. However, many others may wish to collect additional information about the operation and specifics of this service.

Pros of Perfect Money:

1. Transaction Anonymity:

When transferring Perfect Money, the eventual recipient only has access to the account number and the user's login.

2. Instant Transactions:

Payments are processed inside the system in a couple of seconds.

3. Convenient and Straightforward Interface:

The site is not overloaded and is simple to use, even for beginners.

4. A Large Number of Partner Points:

Each user may choose the best deposit or withdrawal method for themselves. Customers may utilize borrowed money to conduct their enterprises or use this option to supplement their income by acting as a lender.

5. The Availability of a Mobile Application:

In many cases, a mobile application can be a quick and convenient solution to make payments promptly.

6. The Availability of an Affiliate Program:

You have the opportunity to earn passive income with the Perfect Money referral program.

Cons of Perfect Money:

1. Money transferred improperly cannot be returned and applies to any unauthorized activity on your account. In these cases, the government does not respond to any circumstances.

If you want to exchange Perfect Money for a good exchange rate, press the button below!

Popular Perfect Money exchange directions:

- Exchange Perfect Money to USDT

- Exchange Bitcoin to Perfect Money

- Exchange USDT to Perfect Money

- Exchange Perfect Money to Bitcoin

Sell Tether for Perfect Money and get a 1.6% bonus

The bonus will work if you buy Perfect Money USD or Perfect Money Voucher USD with Tether TRC20 or Tether ERC20. The offer is valid until reserves run out.

Buy Perfect Money USD with Tether TRC20 at a special rate

3 comments

3 comments

It is currently possible to convert Tether TRC20 to Perfect Money USD and Perfect Money Voucher USD for a special (reduced) rate. The special offer is valid until the reserve runs out.

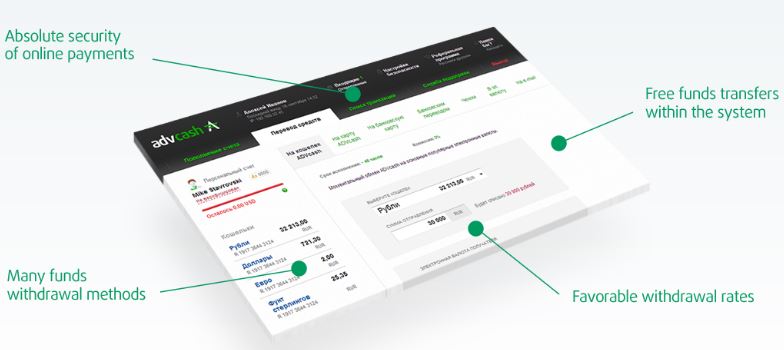

Advcash Wallet Review: Sign up, Log in, Fees, Security, Verification

1 comment

1 comment

AdvCash - What it is and how it works, we will find out in this review. In the age of modern technology, almost every person working with online payment systems has an idea about electronic wallets. We will begin our brief review on one of the most well-known payment systems – Advanced Cash (Advcash). Although it is still a new system and is only gaining popularity, it can already compete with such giants as, for example, Perfect Money or Payeer. We will give you a brief overview about this payment system.

This review includes the following topics:

- 1. Overview and History;

- 2. AdvCash Cards;

- 3. AdvCash Referral program;

- 4. Registration;

- 5. AdvCash Verification;

- 6. Rates, balance replenishment and withdrawal of funds;

- 7. Setting up the safety of the profile;

- 8. Advantages;

- 9. Disadvantages;

- 10. Conclusion.

What is Advcash and how does it work?

Legal Information. Advanced Cash holds licenses from the International Financial Services Commission of Belize to do these types of business:

- - International Money Transmission Business № IFSC/60/237MT/18

- - International Payment Processing Services № IFSC/60/237PPS/18

ADV Project Limited: Suite 16, Watergardens 5, Gibraltar GX11 1AA.

For convenience, the users often abbreviate and simplify the name. Such abbreviations as AdvCash, Advanced Cash, ADV, Adv cash and others have become well known. Here is some general information:

- - The payment system is located on the official website www.advcash.com.

- - AdvCash wallet has the address wallet.advcash.com. Passing the registration, the new user visits this domain automatically. The fact that you have come to the right place is indicated by the green lock in the address bar. This is a certificate of encryption and data protection, it uses the HTTPS protocol, and therefore, the confidential information of the users is reliably protected.

- - The interface uses only 2 languages – English and Russian.

The company was registered in 2014. The first day of work is 27 September. The place of birth – the city of Belize, located on the shores of the Caribbean Sea. The successfully passed certification allowed obtaining all the necessary licences for work. Being an offshore office, AdvCash is not affected by the laws of other countries, which allows significantly reducing costs, reducing tax and provides anonymity. EPS has branches in many countries of the world, including Russia (the office is located near Samara, in the city of Togliatti). There is also a telephone support line and representational social networks. Here you can always ask your question and receive an adequate and complete answer to it. Advanced Cash supports several types of currencies which can be freely exchanged within your personal account:

- - Dollars;

- - Euro;

- - Pounds sterling;

- - Hryvnia;

- - Roubles.

What can you do with Advcash?

- Transfer of funds between users;

- Receiving online payments on your site;

- Payment for goods and online services on the Internet;

- Buying and selling cryptocurrency;

- Receiving additional income from participating in a refferal program;

- Buying electronic products and goods on Buysellvouchers.com. In this video tutorial you will learn how to buy gift cards with Advcash on the Buysellvouchers marketplace:

Advcash cards

Advcash is famed for its bank cards. For many customers, it is the main reason why they chose the Advcash payment system. Money withdrawing at ATMs by Advcash bank cards is a very popular cashout method in the e-currency market.

The client has the opportunity to use not only a plastic card but also create a virtual card. This service is available in almost all electronic payment systems. It works as a standard, allowing you to pay for goods and services on the Internet.

Advcash affiliate program

There is an affiliate program in AdvCash. It allows you to receive a percentage of the number of referrals transferred, which provides the account holder with additional income. Your account is credited every time Advcash charges a fee from your referrals. You will get up to 20% of that commission from 1st level referrals.

Advcash mobile applications

The site is regularly updated, and overgrown with new functionality, and also in the future, at a later stage it is planned to release mobile applications for the convenience of managing payments through phones and tablets running on the android and ios platforms.

Concluding the brief review, I would like to note that the recently invented payment system AdvCash has already captured a certain part of the market of electronic payments and does not intend to stop there. So what do we need to work with this EPS?

Advcash - sign up

Naturally, in order to get started, we have to go to the official website of the Advanced Cash wallet. This procedure is very easy to go even for the most inexperienced user.

The registration has a specific algorithm. Let us consider it in detail. Going to the main page, we scroll down and see a button to create an account. We click it and go to the next step. On the new tab, we will be asked to fill in our personal data, as well as to select an account type for future use:

- 1. Business – is often used by legal entities, as it allows for a huge number of operations;

- 2. Personal – the account is needed if you are a natural person.

After selecting the account, enter the actual information about yourself. Why is it necessary to use real data? Everything is simple – they will be necessary for us for the further verification procedure in AdvCash. The details for the work must be written in English letters. Filling out the form, specify the name, as well as the surname and the actual email address. It will become the login for the access and the number of our wallet AdvCash. Then invent a password with a content of at least eight different characters (letters and numbers of different registers, special characters can also be used). It is better to use a completely disconnected set – this allows the AdvCash payment system to reliably protect your account from hacking. When we fill in the relevant information, we “give the go-ahead” to unlock the button for ending the registration. By holding the slider with the left mouse button, drag it to the opposite position and complete the registration (as shown in the image above). Next, a new page will appear, where you will be offered to go straight to work, or first verify your account and set up a secure profile. If you close this window, it is possible to go immediately to the personal data page. We have the ability to manage three main accounts (rouble, dollar, euro) and two additional (hryvnia and pound sterling). Properly completed registration, even without passing data verification, allows you to easily use all the features of Advanced Cash. But, if you want to transfer money from the card to the balance or cash out a large amount of funds, you will still have to verify your account, plus it will immediately protect you from the most potential incidents of mistrust on the part of the administration.

Advcash - verification

Under the name of the wallet, you can see the inscription “Not verified.” It implies that the owners of the system and its participants do not completely rely on you, which will limit some operations on the account. In order to successfully continue working with the service, we need the verification of the account. Therefore, click on the name located at the top of the window.

In the opened tab, you need to enter your personal data in the following order:

- 1. Country;

- 2. City;

- 3. Post office index;

- 4. Home address;

- 5. Telephone number;

- 6. Language.

You can still fill in the contact details of Skype, but this is not necessary. The email box is already listed because it was entered earlier at the time of registration of the wallet. Click the "Save" button and go on. The “Verification” section requires a lot of attention, as it is the information that the AdvCash payment system operator will check. We have three tabs accessible. This is the address, phone number, and passport. When you click on each of them, a window opens for loading the document. In order to confirm your identity, click on the icon “Passport”. Here you need to download the scanned graphic document, the size of which must not exceed 800 * 600 pixels. You can use a driver's license (scan from both sides). Make sure that the drawing is clear, otherwise, the check will take longer and it is likely to get rejected. Then go to the window "Address", where they demand from you:

- - receipt of payment for utility services;

- - bank statement;

- - document of payment for Internet or telephony.

There is no need to send all the documents. The main thing – is the accuracy of information recognition, as well as an indication of the name and address on the same page. The complete list of the possible documents and requirements for them are specified on the company's website.

Usually, the information is checked during the day, excluding holidays and weekends. When the specialist is authenticated, you will receive an email about the wallet verification results. If the fields and forms are filled correctly, you will be provided with additional features of the Advanced Cash payment system, as well as guaranteed account security. If the test fails, the operator will tell you the reason. You just need to fix the error. The telephone is attached very simply: just enter the number, and you will receive a message. It will contain the code that must be entered into the check box. Now the verification of the AdvCash account is completed. By logging into your personal account, you will see a status change near your name. Next, we will deal with the proposed rates, as well as determine how to operate the payment system.

Advcash - rates, balance replenishment, and cashout

Each payment service has its own tariff grid of operations. Advanced Cash provides a fairly democratic commission for various transfers, wallet replenishment, and withdrawals. Account replenishment is performed by several methods. Enter the page of your account and open the appropriate tab. Then you have to choose the desired amount, and the method of payment and indicate in which of the currencies you want to receive it.

Balance replenishment is possible by using the following methods:

- - E-currencies;

- - Cryptocurrencies;

- - Top up with a bank card;

- - Payment from a mobile phone;

- - The use of exchange points. Each such point with which the Company cooperates puts forward different conditions.

It is necessary to carefully find out which method is the most beneficial for you because the percentage taken during the transfer is different. Internal transfers will be available if you go to the tab "Transfer Funds". Further, according to the algorithm, you must select the recipient and approve the operation. Withdrawal is the same as replenishment. Methods for cashing money are specified above, therefore, we will not go into details.

It is very convenient in this case to use the protection code: until the payer enters the code (reported by you personally), he will not receive the right to use the electronic means. If the code has not been used, the money is returned.

Advcash - profile security settings

Now we know a little more about the Advanced Cash electronic payment system. And, to provide pleasant and safe work in it, you must protect your account from various types of fraud.

A standard set of functions will allow it. In order to do this, go to the section in the top menu "Security Settings”.

Advanced Cash supports several ways to protect your e-wallet:

- IP identification. Here you can specify the allowed IP addresses which you consider safe to enter. If the input was made from another place, the security system will prohibit any manipulations;

- The intellectual recognition method. It turns on automatically after registration. If you change any of the settings, Advanced Cached will ask you to enter a pin code of several numbers, which has been sent to an email box tied to your account;

- SMS authorization. It is a standard procedure that includes receiving a message with the necessary code;

- The use of a code card involves obtaining a graphic image containing a set of unique characters. With each transfer of money, you will need to enter the code from the picture. The copy is sent to the email box;

- The password for payment. The user has the opportunity to invent his/her own unique password, which will be requested by the EPS for each operation;

- Two-Factor Authentication (2FA). When transferring and receiving large electronic amounts, this method will be the right one. It will reliably protect your wallet if all funds are stored in the same account.

You can personally choose what level of data security you need. It depends on the volume of the payment transactions and the amount of money in the account. First, you need at least a minimum security setting.

Advantages of AdvCash

When using any payment system, there will be some advantages for you, but, at the same time, there will be also some disadvantages.

We propose to consider the main advantages and disadvantages of the payment system AdvCash.

Advantages:

- - Multi-level protection of the wallet;

- - The opportunity to have passive income (affiliate program);

- - Transfers within the system without commission;

- - Issue of your own cards for withdrawal of funds (Temporarily suspended);

- - Convenient verification by SMS;

- - Anonymity of the user (offshore);

- - Low fees;

- - New features and options added regularly.;

- - Several ways of depositing and withdrawing funds;

- - The ability to work with a wallet without verification (although not recommended).

Disadvantages of AdvCash

There are more advantages than disadvantages, but there are some disadvantages as well:

- - Payment cannot be returned if you make a mistake when entering the recipient's data (except for the cases when the code is used – this is stated above);

- - Replenishment from the mobile account is subject to a large percentage of the commission;

- - So far there are no applications for managing the wallet from a smartphone or tablet.

How to buy Advcash?

If you want to buy Advcash fast, securely and with a low fee, then you can use XMLGold e-currency exchange. XMLGold provides one of the best rates for e-currency and cryptocurrency exchange in the market. Quite often XMLGold has special offers with zero fees or even bonuses for currency exchange. Thanks to XMLGold you will be able to buy or sell AdvCash with Sepa Transfer EUR, Perfect Money EUR/USD, Payeer EUR/USD, Bitcoin (BTC), Litecoin (LTC), Tether (USDT), USD Coin (USDC), True USD (TUSD), XMLToken, etc.

Tutorial on how to exchange USDT to Advcash:

In most cases, currency exchange will be instant and with low fees. XMLGold is one of the most reliable online e-currency exchange platforms and works already for more than 12 years (since 2006). Besides low exchange rates XMLGold also offers profitable Referral and Discount programs to its customers. Plus the same like Advcash, XMLGold offers also a Prepaid Card program to its customers. At the moment, unfortunately, the Prepaid Card program is temporarily suspended.

Conclusion and feedback on AdvCash

Taking into account the relatively recent start of work, Advanced Cash regularly performs all the basic functions of an electronic payment system. Its development goes by leaps and bounds, thanks to competent developers.

The experts predict a big future for this system, as the number of clients is growing day after day. This conclusion is quite logical because the service provides its users with a huge number of opportunities, as well as cares about their security at the highest level. It is enough to talk with a person who has been using this EPS for quite a long time, and he will immediately advise you to register for this system. Concluding the review on the use of Advanced Cash, I would like to make some recommendations that are applied to all payment systems: be sure to set up a secure login, do not keep all your personal funds on one account, and be careful when entering passwords, never disclose them to unknown persons.

If you want to buy Advcash with USDT (TRC20) press the button below.

Nigeria and Binance Build a Blockchain Hub City for Blockchain Projects

The Nigerian government agency in charge of export processing zones, NEPZA, is negotiating with cryptocurrency exchange Binance to create a "virtual free zone" devoted to blockchain technology and the digital economy.

NEPZA's efforts aim to create an environment analogous to Dubai's digital free zone. Binance pledged in December 2017 to help Dubai build an industrial center for global digital assets, encouraging sustainable economic growth and attracting a broad range of crypto firms to become licensed in the emirate.

NEPZA's efforts aim to create an environment analogous to Dubai's digital free zone. Binance pledged in December 2017 to help Dubai build an industrial center for global digital assets, encouraging sustainable economic growth and attracting a broad range of crypto firms to become licensed in the emirate.

Bloomberg claims that the government of Nigeria is in advanced discussions with the crypto exchange giant to jointly construct a digital region in the nation, which would benefit the development of Fintech and digital assets across Africa.

Bloomberg reports that the goal is to create a digital center similar to Dubai, which has banned the open advertising of its Bitcoin and blockchain industries.

Nigeria, the most populous country in Africa and one of the wealthiest in commodities, notable oil, has been focusing on digital assets and blockchain to diversify its economy for some time now. It is helped by the fact that Nigeria also has one of the youngest average populations.

Companies like Interswitch Ltd. and Flutterwave Inc. are indicative of Nigeria's increasing dependence on the financial technology industry. Nigeria is the sixth most adopted nation in the world for digital currencies, according to the latest statistics from Chainalysis' Global Index Adoption.

CoinGecko revealed that Nigeria had the most significant increase in interest in cryptocurrencies after the market for virtual currencies began its stunning drop in April.

In June (2019), the Nigerian stock exchange stated that it would implement a blockchain-enabled platform to boost commerce and attract younger investors. A partnership between the Nigerian government and Binance has solidified Nigeria's ambitions to become a global crypto powerhouse.

Prof. Adesoji Adesugba, CEO of the Nigeria Export Processing Zones Authority (NEPZA), who is primarily seen as the government's principal point of contact in its intended relationship with Binance to execute this objective, said: “We want to create a flourishing virtual free zone to capitalize on the roughly trillion-dollar virtual economy present in blockchain and the digital economy.”

Binance sees Nigeria as a nation with a lot of promise. This collaborative initiative seems a great way to get into the market there. There is a long-term goal of spreading business over all of Africa.

After three years of infringement procedures in several countries, including Great Britain, which banned the exchange's activities there, Changpeng Zhao's exchange has begun significant collaboration with government and regulatory authorities in the countries in which it operates to get a license to function, as was recently accomplished in Italy and France.

A few weeks ago, Binance signed a similar landmark agreement with the Korean city of Busan. The exchange presumably provides technological and infrastructural assistance to Busan in its blockchain development efforts.

If you want to buy Bitcoin with Perfect Money, press the button below!

The related articles:

- E-Commerce Giant Mercado Libre Debuts An Ethereum-Powered Coin In Brazil

- Hyundai's Securities Affiliate To Add Crypto Data To Its Asset Management Platform

- Coinbase Refutes Claims That It Lists Securities As SEC Kicks Off Investigation