What is a cryptocurrency average user from the available statistic data?

According to observations of the agency, the majority of the users of cryptocurrency exchanges live in the USA – more than 30%, in Russia – more than 15%, and in China – more than 11%.

The experts of the marketing agency BDCenter from Belarus analysed the work of the 30 most popular cryptocurrency exchanges in the world.

The most popular exchanges include Binance, Okex, Huobi, Bitfinex, Upbit, Zb.com, Hitbtc, Coinbase, Kraken, Bitstamp, Bittrex, Gate, Poloniex, Gemini, Coinsbank. In the USA, the average age of traders is 30 years, in China – from 20 to 30 years, in Russia – from 18 to 40 years. More than 70% of the users are men, half of whom have a university degree in relation to economics or mathematics. It also turned out that the most popular cryptocurrencies at the auctions are bitcoin, ether, ripple, bitcoin cash and litecoin. Most often, cryptocurrency exchanges work with 2–3 fiat currencies.

Most of all income to the exchanges is brought by the commissions from trading, not listing. The most expensive listing price of cryptocurrency is Huobi ($ 3.5 million), Bibox and Binance ($ 1 million each). The most popular listing fee is 10 BTC. 13 out of 30 analysed exchanges have their own token.

The related articles:

Investigators in the United States will take courses on the disclosure of cryptocurrency crimes

The American company BIG Blockchain Intelligence Group (BIG), which operates in the field of data analysis, risk assessment relating to the virtual assets, and conducting the search for cryptocurrencies, has developed specialized courses for the representatives of law enforcement agencies.

The program is scheduled for 8 hours of training. It goes online for investigators investigating cryptocurrency cases. To obtain a certificate, you have to study the 5 modules of the course, and then pass the exam. The program was developed with the participation of the former agent of the security investigation who is also an expert in combating money laundering and illegal financial fraud.

And if initially the training courses were intended only for law enforcement officers and government regulators, now they can also be attended by the representatives of the commercial and private sectors. Among them there are financial analysts, private detectives, corporate experts and others. In the opinion of the authors of the program, students do not have to be a professional in programming and cybercrime in order to successfully investigate the cases involving digital money.

What is Tether and how to exchange USDT to USD?

Tether is a cryptocurrency, the value of which is connected with the value of the U.S. dollar. The main idea behind the Tether (USDT) — to create a stable cryptocurrency (stable coins), with low value fluctuation possibility, unlike many other cryptocurrencies (large value fluctuation). However, in practice, the Tether price tends to fluctuate a little. Tether, Like other cryptocurrencies uses blockchain. Official website: https://tether.to/

Creators & Location

USDT is designed by Tether Limited. This company is located in the British Virgin Islands referring on information from the New York Times. The available information in Tether’s website says it is incorporated in Hong Kong, with offices in Switzerland.

Benefits

- - Fixed value (1 USDT is equal to 1 USD);

- - Transaction fee between Tether users 0%;

- - Fast transactions (normally a few minutes);

- - Free Tether wallet;

- - Just like many other payment systems Tether offers API support.

Many cryptocurrency exchanges offer USDT as a trading pair, which gives opportunity to buy the coins the value of which is equal to USD. That can help for traders (especially if Bitcoin’s value is volatile). On the other hand, the Tether value in connection with USD gives a centralized nature for this coin. But as we know, the cryptocurrency was created with the aim to be decentralized.

Anyway, Tether’s centralized nature doesn’t make it bad automatically. It is just a little different type of coin, for example, something more to Ripple category than Bitcoin.

However, USDT is an interesting coin, with a good background and can be a useful coin for Cryptocurrency traders. According to the results of Coinmarketcap.com (See more: https://coinmarketcap.com/currencies/tether/ ), USDT, at the moment, is the 8th largest coin. These are impressive numbers and prove the loyalty of the cryptocurrency traders for this coin.

How to exchange USDT to USD?

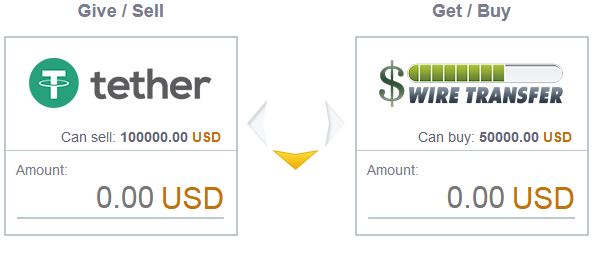

One of the best places where you can securely buy, sell or exchange Tether will be the XMLGold.eu (e-currency exchange). XMLGold guarantee fast transactions and acceptable commissions. At XMLGold you can buy, sell or exchange Tether USD & EUR in many other currencies, cryptocurrencies, for example, Wire Transfer USD and EUR, Bitcoin, Perfect Money, Payeer, AdvCash, Perfect Money e-Voucher, Bitcoin Cash, Litecoin, ePay, eCoin Code, Sepa Transfer EUR, Ex-Code, C-CEX Code Wex-code etc.

How does it work?

What you need to do – simply select the currency you want to sell on left side and currency you want to purchase on the right side. Fill the amount, your e-mail address and press „continue”. It is that simple.

Note: If you want to sell or buy larger amounts, then choose the option „Extend Reserve / Buy, Sell More” and Support will find quickly the necessary amount of the currency you need.

The related articles:

SEPA transfer time, regulations and countries

In this review, you will find the information about: the SEPA transfer time, countries, regulations, payments, benefits and disadvantages!

What is Sepa payments?

The Sepa or “Single euro Payments Area” is the area (SEPA countries) in which citizens, companies can make payments in EUR inside and outside state frontiers, under equal, constant rules and with the same rights and obligations.

SEPA countries list

The “Single euro Payments Area” includes 34 States: the 28-member States of EU (European Union), plus Iceland, Monaco, Liechtenstein, Switzerland and Norway, San Marino and Andora.

History

The SEPA or “Single Euro Payments Area” was created by initiative of the Banking Sector and promoted by the ECB & European Central Bank (official website: https://www.ecb.europa.eu/ ) and the European Commission. It was the step towards EU countries better integration after the introduction of the euro. The aim was to make money transfers more simplified and equal for citizens from EU countries.

At the same time, while it is a single currency system, there are many other countries included within the system in which the EUR currency is not used, but in which you can still have Euro Bank account, which makes it a considerable portion of the European market.

Sepa regulation & benefits

Better cross-border bank transfers within the euro area. Transactions will be faster, costs - lower. Payment should be completed within the validity period of the guarantee, and banks will not be allowed to make any kind of deductions of the amount transferred. Customers will also receive simple and clear information on any charges, fees, so it means that there will be no hidden fees, unwanted surprises from the local bank.

Disadvantages

- Restricted access, availability.

Statistics

The “Single euro Payments Area” transactions and activities involve more than 500 million citizens and over 20 million businesses. Lower money transfer fees, fast transactions, equal and clear rules give boost for European region business. At the same time, Sepa serves as the fiscal and as political instrument.

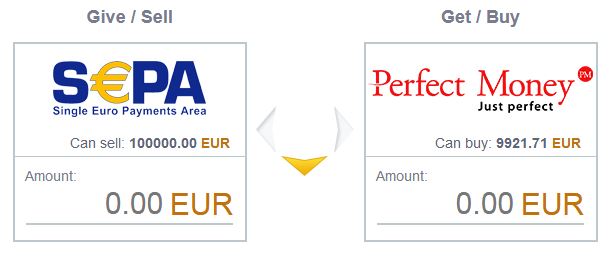

Sepa payments - How to use the SEPA Transfer?

At XMLGold.eu (online e-currency exchanger), you can buy, sell or convert Sepa Transfer EUR in many other digital currencies, cryptocurrencies, for example, Bitcoin, Perfect Money Voucher, Bitcoin Cash, Litecoin, Advanced Cash (AdvCash), Perfect Money, ePay, Wire Transfer EUR or USD, Payeer, eCoin code, Exmo (Ex-code), C-CEX code, Wex code, Tether coin (USDT) etc.

How does it work?

Simply select on the left side/window what currency you want to sell and on the right side what currency you want to purchase/buy and fill the necessary information. It is fast and simple. Note: If the particular reserves are over. You can always choose the option „Extend Reserve” (Buy/Sell More”). Simply click on the bottom – „Extend Reserve” and order the currency and the amount you need.

Sepa transfer time

By using XMLGold.eu online currency exchange platform in average the SEPA transfer will long from 1h to 24h. For example, the ordinary Bank Transfer can long from 2 to 5 days and even with larger commissions.

We hope that Sepa review was useful for you!

The related articles:

SWIFT banking news

SWIFT gpi vs Ripple

SWIFT company: the standards innovation has nothing to do with RippleNet.

The international banking network SWIFT announced its plans for innovation and the upcoming transition to the SWIFT gpi (global payment innovation) standard, which will make transactions completely transparent and traceable. Unexpectedly, this news gave rise to the rumours that the upcoming changes are related to the introduction of Ripple technologies into the system. As if SWIFT is going to provide more than 4,000 banks with access to the services of the company.

The management of SWIFT was quick to deny these rumours. The representative of the company confirmed that the protocol standards will be changed, but this has nothing to do with Ripple. The purpose of SWIFT is to incorporate tracking links into payments that will allow banks to follow the transactions in real time.

The related articles:

Bank of America tries to be mobile and search development possibilities also in the cryptocurrency sphere

On these days, banks try to be mobile by following the trends and customer caprices. Bank of America is not an exception. The latest news inform, that Bank of America has received a patent for the system of storage of private keys. During the previous weeks, Visa and Mastercard have also spoken about similar kinds of activities.

The attitude of the banking industry to cryptocurrency begins slowly to change. There are already the banks which have integrated cryptocurrency. Last week, the second-largest US bank, Bank of America, received another patent in the sphere of blockchain and cryptocurrency, this time related to the remote storage of private keys.

The patent application was submitted by the bank two years ago, in September 2016, however, it was registered and processed only on 30 October. The patent refers to the problem of storing private cryptographic keys, and states that "the available devices do not provide an immediate response to violations." It is also pointed out that the majority of private keys are stored on the consumer-level devices and can be easily cracked.

In fact, Bank of America wants to act as a kind of private key bank – a digital safe which will insure and secure the assets it contains. Undoubtedly, such a product will quickly find its consumer, but the presence of a patent means that the bank will operate without competitors for a long time.

It is planned that Bank of America will promptly (in real time) inform its customers about the attempts to break their private keys and provide the means of counteracting. Such an invention will be useful for all types of customers, but the main consumers of the service may be cryptocurrency exchanges, most often subjected to hacker attacks.

Whether this product will be used, time will tell. However, the secure storage of private keys remains an important problem for the cryptocurrency space, especially taking into account the fact that with the growth of the community, the number of people willing to get rich at the expense of it also increases.

The related articles:

- Mastercard Files Patent for Blockchain System to improve Card service

Visa claims that cryptocurrency does not pose a big threat and that in case of necessity it will be supported

“If the global market moves towards accepting consensus currencies like Bitcoin and Ethereum, in the future, Visa will consider the support for cryptocurrency”, Alfred Kelly, the CEO of Visa, points out.

Kelly believes that in the short and medium term, cryptocurrency will not pose any threat to the reserve currencies that form the basis of the Visa products. However, as digital currencies spread, the company is planning to meet the demand for this type of asset.

“We wish to be at the center of all the payment flows in the world, regardless of how they occur and what currency is at the basis of the process. Therefore, if we need to go there, we will go. However, right now, cryptocurrency is more a product than a means of payment.”

The company Visa is the most influential payment system of the financial sector and is one of the most profitable businesses along with Mastercard.

Kelly claims that in the long run, the cryptocurrency users will be able to send and receive digital assets through the Visa platforms, paying commissions to the company, i.e. Visa will act as an intermediary.

However, by the time the company Visa considers it necessary to integrate cryptocurrencies, intermediaries may no longer be needed for processing payments to digital currencies. By introducing the non-custodial wallets and the platform of the open source code, the cryptocurrency users have got a chance to efficiently and securely transfer digital assets without paying additional fees.

Now, while cryptocurrencies are not used by trading companies, it is quite difficult to make a digital currency payment for simple products like coffee. A Visa-level financial institution would be able alone to significantly increase the percentage of use of cryptocurrencies by sellers. However, the company Visa is planning to enter the cryptocurrency sector as an intermediary only after a few years, when cryptocurrencies will already be massively used as an alternative to fiat money.

The support and experiment with cryptocurrency is needed just now – at the time when it is experiencing exponential growth and is still at an early stage of development. It is quite obvious that in a few years the cryptocurrency sector will rely mainly on decentralized systems and services. The companies such as Fidelity, Goldman Sachs and Citigroup have already started serving the customers of the cryptocurrency market, seeing a significant demand for a new kind of assets.

However, Visa, Morgan Stanley and some other financial institutions still prefer to wait.

Mastercard submits patent for blockchain system to improve card service

MasterCard is about to get a patent for managing partial reserves of digital assets. The annex to the application describes a system which will simultaneously track cryptocurrency and fiat assets, in other words, a web wallet in combination with the cryptocurrency and fiat accounts. In fact, the patent describes a network of cryptocurrency credit cards.

“It is necessary to improve the storage and processing of cryptocurrency transactions on the blockchain. The existing payment systems and the systems of payment processing which use the fiat currencies are specifically designed and configured to securely store and protect information, the credentials of consumers and trading companies, and the transfer of confidential data between the computing systems. Besides, the existing payment systems are often configured to perform complex calculations and risk assessments, and their application algorithms for detecting fraudulent actions work extremely fast with the aim to provide efficient processing of currency transactions,” it is pointed out in the application.

“Accordingly, the use of traditional payment networks and payment system technologies in conjunction with cryptocurrencies on the blockchain can provide consumers and merchants with the advantages of a decentralized blockchain, while maintaining the security of account information and providing reliable protection against fraud and theft.”

Mastercard sees advantages in combining the traditional and cryptocurrency technologies, and the described system most likely includes the existing products and payment networks of the company.

“The transactions which can be made through the payment network can include the purchases of products or services, credit purchases, debit transactions, transfers and withdrawals, etc. The payment networks can be configured with the aim to perform cash equivalent transactions, which may include payment cards, checks, operating accounts, etc.,” it is stated in the patent application.

MasterCard strives to do the things the company does best – to process transactions. MasterCard can potentially make a huge contribution to the Bitcoin economy, allowing millions of the existing customers to accept cryptocurrency payments.

In October, the company patented a blockchain system for supporting multiple currencies, but in September, it applied for a blockchain patent to track payments.Besides, last autumn, MasterCard submitted patent applications for instant payments in the blockchain, and in February of this year, it was reported that the company plans to patent 30 blockchain developments.

In April, Mastercard submitted a patent application for protection of personal data identity using the blockchain, and in June – on the blockchain to verify the coupons and protect the card data. In addition, this year, the company received two more patents – on the technology of linking the account to the cryptocurrency and the technology of anonymous blockchain transactions

Tether burned 500 million USDT tokens

The company Tether Limited, which is backing the Tether coin, a crypto token pegged to the USD, has announced about the destruction of its 500 million USDT.

In the official statement of the company, it is said that in relation to the fall of the Tether coin over the last week, it was decided to destroy 500 million USDT tokens. Tether Limited transferred the appropriate amount of tokens to the address previously used for their release, and now it initiated the destruction procedure. At the same time, the company has left 466 million tokens in the wallet for the release of USDT in the future. .

In the official statement of the company, it is said that in relation to the fall of the Tether coin over the last week, it was decided to destroy 500 million USDT tokens. Tether Limited transferred the appropriate amount of tokens to the address previously used for their release, and now it initiated the destruction procedure. At the same time, the company has left 466 million tokens in the wallet for the release of USDT in the future. .

“When the number of the circulating tokens exceeds the necessary amount, for example, for Bitfinex or Tether, they are bought out,” stated Kasper Rasmussen, the director of communications at Bitfinex. He also noted that the most of the destroyed USDT tokens came from the wallets of the exchanges, which is not surprising as Bitfinex is one of the main consumers of Tether.

The possibility to buy out the tokens from the holders was originally announced in the White Paper of Tether Limited. The company emphasizes that each token is provided with US dollars which are in the company's accounts. However, a lot of sceptics doubt these statements.